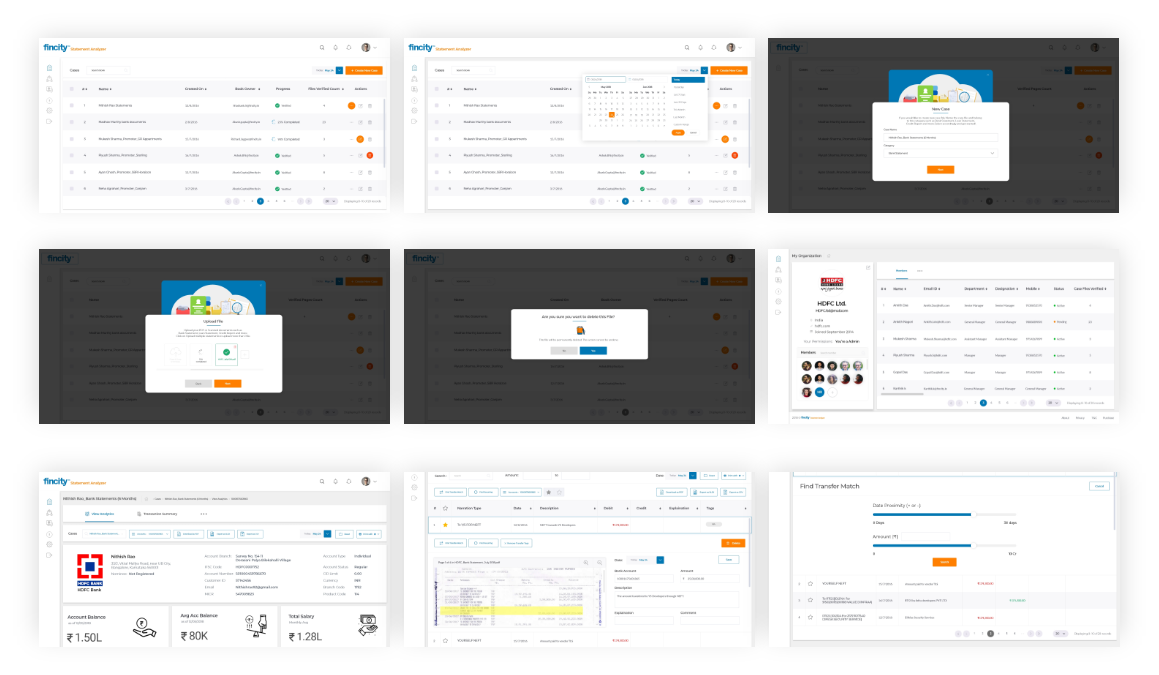

Project Overview

This Client Project, undertaken with Fincity, allowed me to implement a human-centered design approach to address complex user experience challenges. This involved conducting usability testing and task analysis with targeted users.

App Description

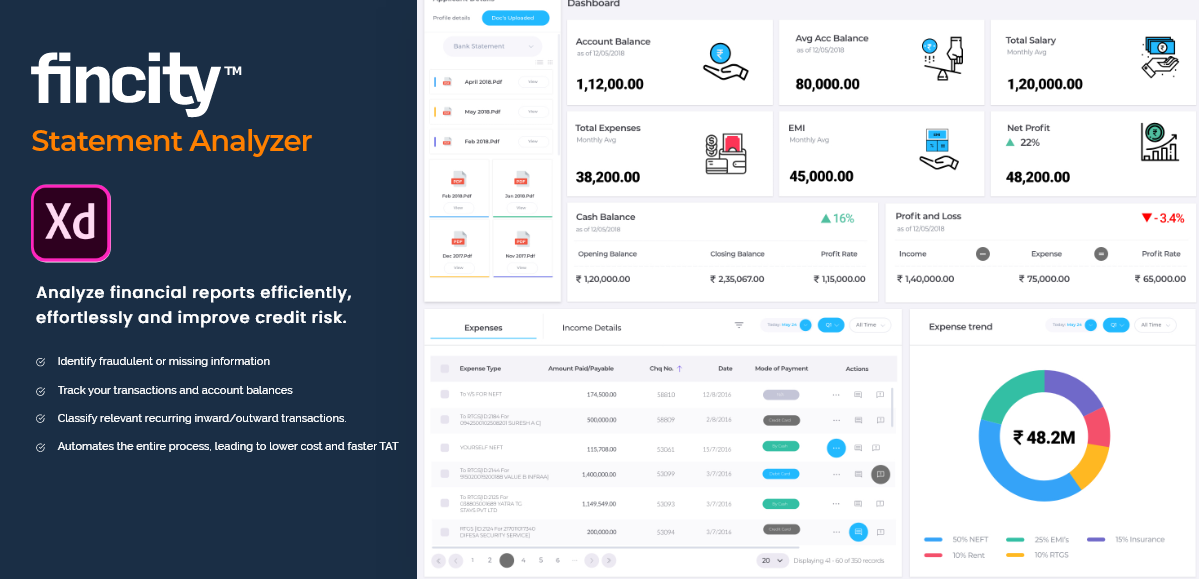

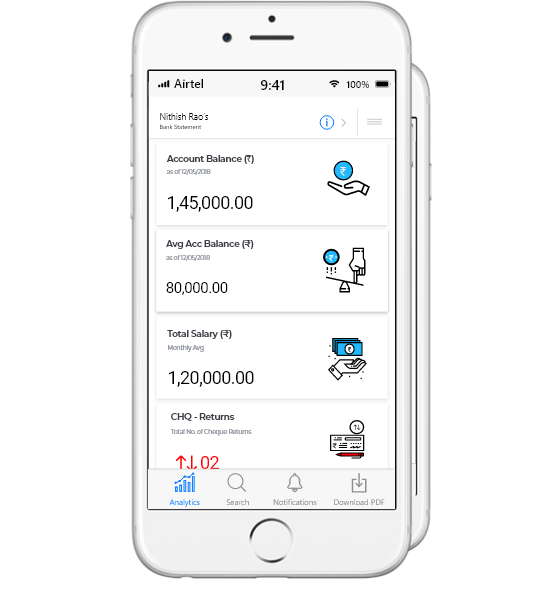

Fincity's AI-driven decisioning platform, the Fincity Statement Analyzer, revolutionizes the loan processing lifecycle by eliminating individual preferences and errors. This technology digitizes the entire process seamlessly.

User Reserach

To conduct comprehensive research for the project and its users, we conducted interviews with stakeholders, chartered accountants, and bank employees.

Interviews & Observation

I had the opportunity to interview and observe chartered accountants, bank employees, and real estate developers seeking loans.

Challenges

How might we help Financial Institutes digitalize document verification process and help them make quick decision on loan processing?Manually analyzing bank statements and credit reports is time-consuming, with bank employees or chartered accountants taking 7-12 working days for tasks like home loans or loans against property. Additionally, for real estate developers, analyzing bank statements for large loan amounts could pose significant challenges if errors occur.

Solution

Our solution involves leveraging technology to digitize the entire loan processing lifecycle. Through an AI-driven tool, documents can be uploaded and scanned within minutes. This tool identifies fraudulent or missing information, ensuring real-time accuracy in financial document analysis, including credit reports and bank statements.

Product Goals

The primary goal of the product is to digitize the entire loan processing lifecycle.

Bank Statement

Automatically analyse bank e-statements with higher accuracyLoan Statement

Analysis of Current Loans, EMI’s, Interest rates, Repayment History & moreCredit Report

A comprehensive analysis that gives you a consolidated view of your credit history.Transactional Analysis

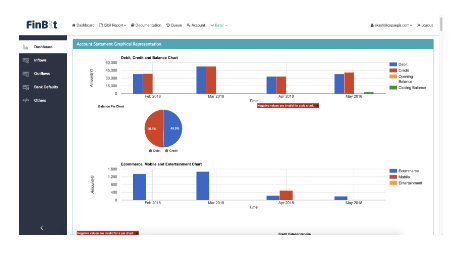

Tracking and monitoring your Spending habits, Interests, Unsusal deposits and WithdrawalsCompetitive Analysis

I conducted research on two competitor applications, Finbit and Perfect Audit, aiming to integrate the strengths of both into this project.

Pros

Cons

User Personas

Shilpa Bounsle

Women IN Tech 35 Years Old Bengaluru, KarnatakaBio

Shilpa Bounsle, is a Bank Manager at ICICI Bank, 9 years of work experience, 10-hour work days, she is from Bangalore, married to Nikhil, lives in Yelahanka, topper from Christ college. Been married for 5 years, Doesn't have kids, orthodox family background.

Challenges

Frustrations

Goals

Needs

Using apps

Language

Dheeraj S

Manager Investments 29 Years Old Bengaluru, KarnatakaBio

Dheeraj, is a Manager - Investments at Sundaram Finance, 8 years of work experience in charted accounting, 10-hour work days, He is from Bangalore, Single, lives in Malleshwaram, topper from St Josephs college. Worked with Deloitte for 3 years as Assistant manager and Deputy manager.

Challenges

Frustrations

Goals

Needs

Using apps

Language

Brainstorming

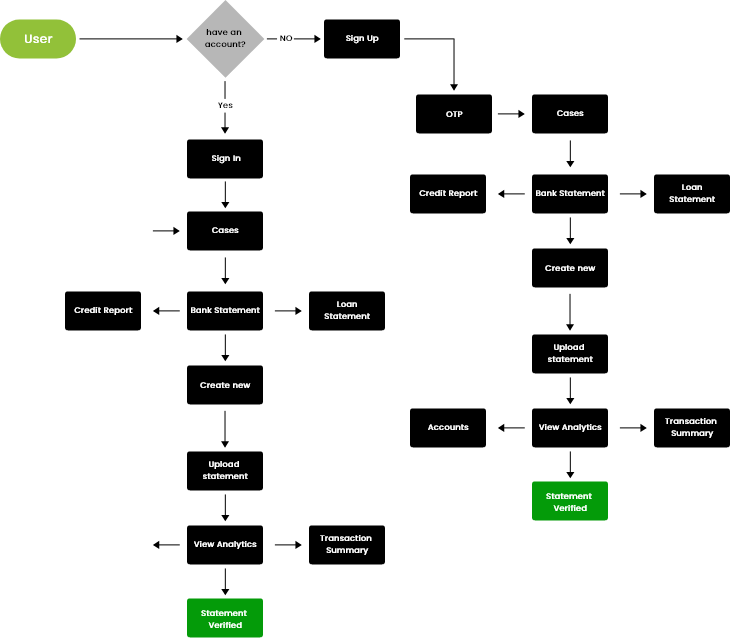

User Flow

TYPOGRAPHY and Color

01. Typography

Aa

Abcdefghijklmnoprstuvwxyz

Abcdefghijklmnoprstuvwxyz

1234567890

Montserat Font

02. Color

#FF8000

#0077B5

#404040

#737373

#B7B7B7

#F3F3F3

Design